Learn about the latest News & Events for DCHFA, and sign up to receive news updates.

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Learn about the latest News & Events for DCHFA, and sign up to receive news updates.

Upcoming Events

No upcoming events. Add this issuer to your watchlist to get alerts about important updates.News & Press Releases

Please click the below link to view all the news articles and press releases that are available on the DC Housing Finance Agency’s government website.

Washington, D.C. – On June 26, 2024, the District of Columbia Housing Finance Agency (DCHFA) issued $29.7 million in tax exempt bonds, underwrote $24.5 million in federal and $4.3 million in DC Low Income Housing Tax Credit equity for the construction of One Hawaii Apartments. The new $61 million Ward 5 development will consist of 70 apartments comprised of 10 efficiency, 38 one-bedrooms, seven two-bedrooms, and 15 three-bedrooms. All apartments will be reserved for residents earning 30-80 percent of area median income. “The agency’s pipeline is active as evidenced by One Hawaii Apartments, our second closing in the month of June,” stated Christopher E. Donald, Executive Director/CEO, DCHFA. This investment is an opportunity to bring beautiful, healthy, and affordable homes to the Fort Totten neighborhood.” Additional financing for the development is provided by a $22.5 million loan from the DC Department of Housing and Community Development’s Housing Production Trust Fund.

The One Hawaii Ave NE Tenants Association exercised its rights under the Tenants Opportunity to Purchase Act and executed a development agreement with Wesley Housing Development Corporation of Northern Virginia to build this new community. One Hawaii Apartments will contribute to the District’s green building goals. The development will be designed to meet the Leadership in Energy and Environmental Design (LEED) Platinum energy standards with both a green roof and solar panels. To achieve LEED Platinum, the developers will include triple-pane windows, a high-efficiency central gas hot water system, and a HVAC heat recovery system all of which can reduce energy consumption by residents, thereby reducing their utility bills.

Through its Multifamily Lending and Neighborhood Investment and Capital Markets divisions, DCHFA issues taxexempt mortgage revenue bonds to lower the developers’ costs of acquiring, constructing and rehabilitating rental housing. The Agency offers private for-profit and non-profit developers low-cost predevelopment, construction and permanent financing that supports the new construction, acquisition, and rehabilitation of affordable rental housing in the District.

The District of Columbia Housing Finance Agency is an S&P AA- rated issuer, serving Washington, D.C.’s residents for 45 years. The Agency’s mission is to advance the District of Columbia’s housing priorities; the Agency invests in affordable housing and neighborhood development, which provides pathways for D.C. residents to transform their lives. We accomplish our mission by delivering the most efficient and effective sources of capital available in the market to finance rental housing and to create homeownership opportunities. The Agency operates from a core set of values: Leadership*Excellence*Community Focus*Integrity*Collaboration *Innovation

Washington, D.C., Dec. 13, 2023 (GLOBE NEWSWIRE) – On December 1, 2023, the District of Columbia Housing Finance Agency (DCHFA) closed its first affordable housing investment of FY 2024 with the issuance of $59.6 million in tax exempt bonds and underwrote $44.8 million in federal and $8.8 million in D.C. Low Income Housing Tax Credit equity for the construction of Edgewood Commons V Apartments (435 Edgewood St NE). The new Ward 5 senior community will consist of 151 apartments. “DCHFA is proud to continue its partnership with Enterprise Community Development in expanding the Edgewood Commons campus and increasing the number of affordable rental housing units in Ward 5, specifically much needed apartments for seniors,” stated Christopher E. Donald, Executive Director/CEO, DCHFA. In August 2023 the Agency invested $54.7 million in tax exempt bonds for the rehabilitation of Edgewood 611 and Edgewood Gardens Apartments both of which are components of Edgewood Commons. Financing sources for Edgewood Commons V include a $26.5 million loan from the DC Department of Housing and Community Development’s Housing Production Trust Fund.

Edgewood Commons V Apartments (ECVA) will be a nine-story $123 million high-rise with 11 efficiency, 135 one-bedroom, and five two-bedroom units. The building will be restricted to senior residents aged 62 and older, earning 30 percent and 50 percent of area median income (AMI) or less. Ninety-six of ECVA’s units will be restricted to residents earning 30 percent AMI or less. Of the 96 units restricted to residents earning 30 percent AMI or less, 56 will be receiving Local Rent Supplemental Program project-based subsidy. Sixteen units out of the 56 units will also be permanent supportive housing units restricted to 30 percent AMI. The remaining 40 units at 30 percent of AMI will receive a rent subsidy through Rental Assistance Demonstrations (RAD) for Project Rental Assistance Contact (PRAC). Additionally, 10 units at 50 percent of AMI will benefit from RAD for PRAC rent subsidies. The remaining 44 units at 50 percent of AMI are unsubsidized.

The units will include universal design features to prevent falls and facilitate aging in place. All units will be fully accessible, and bathrooms will have direct access to bedrooms. In addition to accessible bathrooms, each unit will include pull-cords and grab bars. ECVA will also include a 6,500 square foot adult day care located on the ground floor operated by Easterseals. Easterseals provides daily clinical care, supervision, activities, and curb-to-curb transportation for adults, seniors, and veterans.

Through its Multifamily Lending and Neighborhood Investment and Capital Markets divisions, DCHFA issues tax-exempt mortgage revenue bonds to lower the developers’ costs of acquiring, constructing and rehabilitating rental housing. The Agency offers private for-profit and non-profit developers low-cost predevelopment, construction and permanent financing that supports the new construction, acquisition, and rehabilitation of affordable rental housing in the District.

The District of Columbia Housing Finance Agency is an S&P AA- rated issuer, serving Washington, D.C.’s residents for more than 40 years. The Agency’s mission is to advance the District of Columbia’s housing priorities; the Agency invests in affordable housing and neighborhood development, which provides pathways for D.C. residents to transform their lives. We accomplish our mission by delivering the most efficient and effective sources of capital available in the market to finance rental housing and to create homeownership opportunities. The Agency operates from a core set of values: Leadership*Excellence*Community Focus*Integrity*Collaboration *Innovation

Attachment

Washington, D.C., Oct. 04, 2023 (GLOBE NEWSWIRE) – On September 28, 2023, the District of Columbia Housing Finance Agency (DCHFA) made its nal affordable housing investment of FY 2023 with the issuance of $46.2 million in tax exempt bonds and underwrote $49.4 million in federal Low Income Housing Tax Credit equity for the construction of Carl F. West Estates (1370 Harvard St NW). The new Ward 1 community will consist of 179 units reserved for seniors and grandfamilies. “DCHFA is proud to add another grandfamily development to the agency’s robust investment portfolio. We are continuing to address the need for senior housing and housing with supportive services for grandparents raising their grandchildren,” stated Christopher E. Donald, Executive Director/CEO, DCHFA. “We have had a very active September of deal closings and adding more affordable housing in Ward 1 is a great way to end the scal year.”

Carl F. West Estates (CFW Estates) will be the District’s third grandfamily housing community. Plaza West was the rst affordable grandfamily development in D.C. It opened in 2018 and is in Ward 6. DCHFA provided $44.1 million in tax exempt bond nancing for the project. On September 7, 2023, DCHFA issued $25.9 million in tax exempt bonds for the construction of H.R. Crawford Gardens, the District’s second grandfamily development which will be constructed in Ward 7. Additional nancing for CFW Estates is being provided by the DC Department of Housing and Community Development in the form of a $49.5 million loan from the Housing Production Trust Fund. The bonds are secured by HUD insured loans made under DCHFA’s Level I 50/50 Risk Share Program.

The National Council on Black Aged Housing Development Corporation of the District of Columbia and DMA Development Company LLC are the developers of CFW Estates, a $134.4 million project. The community will consist of 12 efciency units, 110 one-bedroom units, 53 two-bedroom units, and four three-bedroom units. One hundred forty-three units will marketed to traditional active senior (55+) households and 36 units will be marketed to seniors who are primary caregivers for their grandchildren (also known as grandfamilies). In CFW Estates’ nine-story elevator-serviced high-rise building 43 apartments will be leased to tenants earning 30 percent of the area median income (AMI), 119 units at 50 percent and 17 at 80 percent AMI units. Twenty-ve of the 30 percent AMI units will benet from the Local Rent Subsidy Program, of which 18 units will be set-aside as Permanently Supportive Housing (PSH) for formerly homeless seniors. Supportive services will be provided by Miriam’s Kitchen, for PSH and active adult tenants. There will be a full-time social service coordinator that will develop and coordinate service programs for the senior population, as well as grandfamilies.

Through its Multifamily Lending and Neighborhood Investment and Capital Markets divisions, DCHFA issues tax-exempt mortgage revenue bonds to lower the developers’ costs of acquiring, constructing and rehabilitating rental housing. The Agency offers private for-prot and non-prot developers low-cost predevelopment, construction and permanent nancing that supports the new construction, acquisition, and rehabilitation of affordable rental housing in the District.

The District of Columbia Housing Finance Agency is an S&P AA- rated issuer, serving Washington, D.C.’s residents for more than 40 years. The Agency’s mission is to advance the District of Columbia’s housing priorities; the Agency invests in affordable housing and neighborhood development, which provides pathways for D.C. residents to transform their lives. We accomplish our mission by delivering the most efcient and effective sources of capital available in the market to nance rental housing and to create homeownership opportunities. The Agency operates from a core set of values: Leadership*Excellence*Community Focus*Integrity*Collaboration *Innovation

Washington, D.C., Sept. 27, 2023 (GLOBE NEWSWIRE) – On September 20, 2023, the District of Columbia Housing Finance Agency (DCHFA) made its third affordable housing investment of the month with the issuance of $30.5 million in tax exempt bonds and underwrote $20.1 million in federal Low Income Housing Tax Credit equity for the construction of Ontario Place (2400 Ontario Road NW) in Adams Morgan. “The work that Jubilee does is amazing. They transform what was once uninhabitable into fertile ground.” stated Christopher E. Donald, Executive Director/CEO, DCHFA at the groundbreaking of Ontario Place on September 13, 2023. Additional nancing for Ontario Place is being provided by the DC Department of Housing and Community Development in the form of $23.8 million loan from the Housing Production Trust Fund.

Ontario Place is a $61.4 development that will offer 52 units, with 26 of them reserved for returning citizens. The returning citizens will be former residents of Jubilee’s KEB (adjacent sister property) and participants of Jubilee’s existing Supportive Housing programs, or graduates of similar nonprot led reentry programs. Additionally, the 26 set aside units will provide long-term housing options for returning citizens, as well as reunited families. The new four-story building will consist of efciency, one-, two-, and three-bedroom affordable housing units leased to tenants earning up to 50 percent of area median income. Ontario Place will include the rst residential aquaponics system in the District. The produce from the aquaponics system will be offered to residents and used in the preparation of free daily meals for KEB residents. Ontario Place is being developed in accordance with Jubilee’s Justice Housing model, which focuses on providing affordable housing in high opportunity neighborhoods with nearby services. Jubilee’s Justice Housing model focuses on four goals: Housing Stability, High Sense of Community, Financial Security (including Education as a pathway), and Improved Health Outcomes.

Through its Multifamily Lending and Neighborhood Investment and Capital Markets divisions, DCHFA issues tax-exempt mortgage revenue bonds to lower the developers’ costs of acquiring, constructing and rehabilitating rental housing. The Agency offers private for-prot and non-prot developers low-cost predevelopment, construction and permanent nancing that supports the new construction, acquisition, and rehabilitation of affordable rental housing in the District.

The District of Columbia Housing Finance Agency is an S&P AA- rated issuer, serving Washington, D.C.’s residents for more than 40 years. The Agency’s mission is to advance the District of Columbia’s housing priorities; the Agency invests in affordable housing and neighborhood development, which provides pathways for D.C. residents to transform their lives. We accomplish our mission by delivering the most efcient and effective sources of capital available in the market to nance rental housing and to create homeownership opportunities. The Agency operates from a core set of values: Leadership*Excellence*Community Focus*Integrity*Collaboration *Innovation

Financial strength, outperformance of peer agencies and strong management team among reasons for higher rating

Washington, D.C., May 10, 2023 (GLOBE NEWSWIRE) – The District of Columbia Housing Finance Agency’s (DCHFA) credit rating was upgraded by Standard & Poor’s (S&P) on April 21, 2023 from A+ to AA-. As DCHFA continuously strives to increase the supply of affordable housing in the District of Columbia, this upgrade shows the Agency is showing consistent financial results year over year.

“As the District’s population continues to grow and local market-rate housing costs climb, it’s a pivotal time for DCHFA to receive a rating upgrade, as a main financier of affordable housing,” stated Christopher E. Donald, Executive Director/CEO, DCHFA. “DCHFA has worked diligently over the last several years to improve our financial situation by earning stable net income and building the strength of our balance sheet, which has enabled this ratings upgrade. The implications of this rating upgrade are a direct link to our mission of financing affordable housing units in the District of Columbia. The overall economics of the Agency’s transactions improves with higher ratings which is good for the developer, the renter and the District of Columbia as it enables more units to be financed.”

S&P gave four main reasons for the upgrade, including:

- Financial strength, as measured by nearly $167 million in equity, net equity-to-assets ratio of 27.5 percent in fiscal year 2022 and 25.6 percent on a five-year average.

- Above-average profitability compared with that of peers, measured by a five-year average return on average assets of 2.8 percent, and net interest margin (NIM) of 0.8 percent and low-risk asset base, which consists of mortgages either insured by the government and private mortgage insurance providers or backed by Ginnie Mae, Fannie Mae, or Freddie Mac mortgage-backed securities (MBS).

- Strong liquidity, with a short-term investments-to-total assets ratio of 22.6 percent, and total loans-to-total assets ratio of 37.7 percent in fiscal year 2022; and

- Strong management team and board members, with a track record of adapting the Agency’s programs through strategic initiatives that increased the Agency’s asset base through difficult circumstances.

S&P’s outlook for the Agency states, “We believe DCHFA’s strategic initiatives have and will continue to lead to stabilized financial ratios and will position the Agency well to maintain its credit quality even during a downturn. Therefore, we do not expect to change the rating within the two-year outlook period.”

_The District of Columbia Housing Finance Agency is an S&P AA- rated issuer, serving Washington, D.C.’s residents for more than 40 years. __The Agency’s mission is to advance the District of Columbia’s housing priorities; the Agency invests in affordable housing and neighborhood development, which provides __pathways for D.C. residents to transform their lives. We accomplish our mission by delivering the most efficient __and effective sources of capital available in the market to finance rental housing and to create homeownership _opportunities. The Agency operates from a core set of values: Leadership*Excellence*Community Focus*Integrity*Collaboration *Innovation

WASHINGTON, DC - The District of Columbia Housing Finance Agency (DCHFA) has issued $23.1 million in tax exempt bonds for the construction of Alabama Avenue Apartments in Ward 8. The Agency underwrote $22 million in federal and local Low Income Housing Tax Credit equity for the development of this 100 percent affordable community.

“As construction continues to increase in Ward 8, DCHFA is committed to ensuring that long-term residents are able to remain in their communities,” stated Christopher E. Donald, Executive Director/CEO, DCHFA. “Alabama Avenue Apartments will make that possible for 86 individuals and families, and ultimately get us closer to Mayor Muriel Bowser’s goal of 12,000 new affordable homes by 2025.”

Alabama Avenue Apartments will help address the need for family-sized units in the District by including 26 three-bedroom apartment homes. There will also be 28 two-bedrooms and 32 one-bedrooms. Nine units will be reserved for residents earning up to 60 percent of the area median income (AMI) and 59 units will be reserved for those earning up to 50 percent AMI. The remaining 18 units are designated Permanent Supportive Housing (PSH) reserved for residents earning 30 percent or less AMI, and they will receive Local Rent Supplement Program operating subsidy.

Enterprise Community Development, Inc. and Durrani Development Corporation are the developers of this community, with a total development cost of $49.2 million. Additional funding for this project came in the form of a $12.9 million Housing Production Trust Fund loan from the D.C. Department of Housing and Community Development (DHCD).

Alabama Avenue Apartments will be constructed in the Garfield Heights neighborhood. This community is located less than two miles from the Congress Heights Metro Station. It is in walking distance to The Crest at Skyland Town Center which includes a grocery store, pharmacy and other retail. Community amenities will include a laundry facility, bike storage, fitness room, a flexible community space on each floor, and on-site property management and PSH offices.

Through its Multifamily Lending and Neighborhood Investment and Capital Markets divisions, DCHFA issues tax-exempt mortgage revenue bonds to lower the developers’ costs of acquiring, constructing and rehabilitating rental housing. The Agency offers private for-profit and non-profit developers low-cost predevelopment, construction and permanent financing that supports the new construction, acquisition, and rehabilitation of affordable rental housing in the District.

The District of Columbia Housing Finance Agency underwrote the deal.

A joint partnership of Enterprise Community Development and Durrani Development Corp. has secured $23.1 million in financing for the development of the Alabama Avenue Apartments in Washington, D.C.’s Ward 8.

The District of Columbia Housing Finance Agency, known as DCHFA, underwrote the financing, which consists of federal and local low income housing tax credit equity.

In Ward 8, as in other neighborhoods within the nation’s capital, a dramatic need exists for larger, family-sized apartment homes. When completed, the newly built multifamily development will be a 100 percent affordable community.

Meeting demand

With a total development cost of $49.2 million, Alabama Avenue Apartments will feature 26 three-bedroom apartment homes, 28 two-bedroom apartments and 32 one-bedroom units. Nine of the residences will be reserved for residents earning 60 percent of area median income, while 59 units will be cached for residents earning 50 percent of area median income. A remaining 18 apartments are designated as permanent supportive housing. This means they will be set aside for residents earning 30 percent or less of area median income. These renters will benefit from receiving local rental supplements.

Constructed in the Garfield Heights neighborhood of Washington, D.C., Alabama Avenue Apartments will be situated less than two miles from the Congress Heights Metro Station, and within walking distance of The Crest at Skyland Town Center, a shopping center featuring a supermarket, pharmacy and other retail outlets.

DCHFA issues tax-exempt mortgage revenue bonds to lower developers’ costs associated with rental housing acquisition, construction and rehabilitation. It does so through its Multifamily Lending and Neighborhood investment and Capital Markets divisions.

Its goal is to offer for-profit and non-profit developers low-cost predevelopment, construction and permanent financing that will support the creation of affordable rental housing in the District of Columbia. Four months ago, DCHFA funded development of a $105 million affordable community in the District of Columbia.

In late February, DCHFA backed the rehabilitation of 202 affordable apartments at sites scattered across Wards 7 and 8 of the city with $43.1 million of tax exempt bonds for the acquisition and rehabilitation of a 16-building community formerly known as WDC 1. That property includes residences in the Anacostia, Marshall Heights and Fort Dupont neighborhoods. DCHFA also underwrote $33.4 million in federal low income housing tax equity and $6.4 million in D.C. local low income housing tax equity to finance the redevelopment.

Washington, D.C. – The District of Columbia Housing Finance Agency (DCHFA) has financed the rehabilitation of 202 affordable apartments at scattered sites across Wards 7 and 8. DCHFA issued $43.1 million in tax exempt bonds for the acquisition and rehabilitation of this 16-building community formerly known as WDC 1

which spans Anacostia, Marshall Heights and Fort Dupont on February 27, 2023. The Agency also underwrote $33.4 million in federal Low Income Housing Tax Credit (LIHTC) equity and $6.4 million in D.C. LIHTC equity to finance this redevelopment.

Dantes Partners and The Community Builders have lined up construction financing for a fully affordable community in Washington, D.C.

EagleBank provided a $25 million construction loan to developers, which will use it to build housing at 610 Park Road NW. The District of Columbia Housing Finance Agency also previously provided $51.2 million in tax exempt bonds and underwrote $31.5 million in federal low-income housing tax credits for the project.

The five-story community will offer 142 units when fully built out, 40 of which will be public housing replacements. All of the units at the project, which totals 173,533 square feet, will be 100 percent affordable.

Amenities will include a rooftop lounge, pet grooming station, bicycle storage, resident storage and meeting spaces. The sponsors plan to install a rooftop solar system, as well as a below-grade parking garage with 71 spaces.

The community will be part of the Park Morton and Bruce Monroe redevelopment plan being developed by The Community Builders, Dantes Partners and the District of Columbia Housing Authority. The project’s goal is to convert a 174-unit public housing property into a mixed-income community totaling nearly 500 units.

Adding to Mid-Atlantic affordable housing

The two sponsors have constructed several affordable housing projects, with The Community Builders recently breaking ground on a 51-unit mixed-income community in Pittsburgh consisting mainly of affordable units.

Dantes Partners is currently working on upgrading the 132-unit Cascade Park Apartments affordable housing community in Washington, D.C., alongside H Street Community Development Corp. Dantes Partners also partnered with Jonathan Rose Cos. to acquire a 930-unit workforce community in District Heights, Md., which will offer 372 rent-restricted units.

Developers have started construction on two new communities that will sit atop the 14th Street Hill in Washington, D.C. Crescent Communities’ NOVEL 14th Street, a 197-unit market-rate community, which is slated to start welcoming residents in early 2025, will be developed simultaneously with The Faircliff, a 125-unit affordable housing community from Somerset Development Co., Jonathan Rose Cos., and Housing Up.

NOVEL 14th Street and The Faircliff will replace the former Faircliff Plaza East community. The adjacent affordable housing community is adding 45 new units to the original 80 that were on site. Residents of the former Faircliff Plaza East voted unanimously in 2021 to move forward with the overall development, with over 80% deciding to return to live at The Faircliff once it’s completed.

The Faircliff will serve households with incomes at or below 50% of the area median income. Designed by Eric Colbert & Associates, it will be constructed to passive house standards and will feature a green roof, electric vehicle charging for 19 parking spaces, and carbon-injected concrete.

Floor plans at NOVEL 14th Street will include a mix of studio, one-, and two-bedroom units. The Fitwel and LEED Silver-targeted community also will be designed to reflect the area’s bold personality with globally inspired pieces and patterns throughout. Residents will have access to a Land of a Thousand Hills Coffee & Social, which invests in coffee farming villages; a rooftop pool and clubhouse; a ground-level zen courtyard; an expansive gym with a climbing wall and yoga room; multiple co-working spaces; and a library.

“NOVEL 14th Street will be a dynamic addition to one of Washington, D.C.’s most bustling corridors,” said Brandon Wright, managing director for the Mid-Atlantic for Crescent Communities. “Our goal is to provide a thoughtfully crated community that seamlessly weaves itself into the vibrant neighborhood fabric present today and adds sought-after amenities for both our future residents as well as our neighbors.”

The project team includes general contractor J. Moriarty & Associates, architect Hord Coplan Macht, interior designer Streetsense, landscape architect Lee and Associates, and civil engineer Vika Capitol.

NOVEL 14th Street marks Crescent Communities’ second investment in Washington, D.C. It recently sold its stake in NOVEL South Capitol, a community it developed in the Navy Yard District. The multifamily developer and operator also continues to expand its footprint in the Mid-Atlantic region, recently breaking ground on NOVEL Scott’s Addition in Richmond, Virginia.

WASHINGTON, DC - The District of Columbia Housing Finance Agency (DCHFA) issued $51.2 million in tax exempt bonds and underwrote $31.5 million in federal Low Income Housing Tax Credit (LIHTC) equity for the construction of Park Morton Phase I. A part of the Deputy Mayor for Planning and Economic Development New Communities Initiative, this project will help revitalize this transit-oriented, amenity-rich neighborhood and provide 40 public housing replacement units.

“The Park Morton redevelopment has been a labor of love. The journey for this project has taken over a decade and under Mayor Bowser’s leadership we have finally crossed the finish line. Ward 1 is a community of opportunity; the residents who live in this redevelopment will be close to transit, amenities, strong schools and employment centers,” stated Christopher E. Donald, Executive Director/CEO, DCHFA. “Residents should have the opportunity to live in healthy, beautiful, affordable housing in all of the District’s great neighborhoods. Park Morton will grant that opportunity to 142 individuals and families.”

The $105.3 million development will consist of 19 efficiencies, 73 one-bedrooms, 49 two-bedrooms and one four-bedroom unit. All units will be reserved for residents earning 80 percent or less of the area median income (AMI); the 40 replacement public housing units will be reserved for individuals earning 30 and 50 percent or less AMI.

The Community Builders and Dantes Partners are the developers of Park Morton Phase I. The property will be Enterprise Green Communities certified, and it will include a rooftop solar system and 14,000 square feet of green roof area. Other amenities will include a rooftop lounge, fitness room, courtyard spaces, meeting lounges, a pet grooming room, bike storage and 71 garage parking spaces. The garage parking will be free on a first come first served basis. Residents will be only 0.3 miles from the Petworth Metro Station.

Through its Multifamily Lending and Neighborhood Investment and Capital Markets divisions, DCHFA issues tax-exempt mortgage revenue bonds to lower the developers’ costs of acquiring, constructing and rehabilitating rental housing. The Agency offers private for-profit and non-profit developers low-cost predevelopment, construction and permanent financing that supports the new construction, acquisition, and rehabilitation of affordable rental housing in the District.

The District of Columbia Housing Finance Agency has completed financing that will enable the development of two new Washington, D.C., affordable apartment communities. The construction of the 49-unit 3450 Eads St. will take place in the River Terrace neighborhood of Ward 7. Construction of the 169-unit Belmont Crossing will take place in the Washington Highlands neighborhood within Ward 8.

“In 2022, there was significant volatility in the capital markets and for construction pricing,” Christopher Donald, CEO of DCHFA, told Multi-Housing News.

“When the year began, construction loans had interest rates in the mid-threes, which increased to the mid-sixes by the end of 2022. This resulted in strain for project partners with increasing capitalized interest costs, as well as smaller permanent loans. Additionally, construction costs in the District have increased substantially in 2022.”

DCHFA maintained an ongoing dialogue with project sponsors to grasp the always-evolving project budget and capital stack resulting from the volatile market, Donald added. “As a result of Mayor Bowser’s historic investment in the Housing Production Trust Fund, sufficient gap funding was available and funding gaps were addressed in real time,” he said. “Project financing provided by the District was timely and never resulted in project delays. D.C.’s housing partners, including the DCHFA, the Office of the Deputy Mayor for Planning and Economic Development, and the Department of Housing and Community Development, have all been very agile operating under extraordinary market conditions.”

Tax credits

For the construction of 3450 Eads St., DCHFA issued $20.5 million in tax-exempt bonds, and underwrote $14.1 million in federal low-income housing tax credit equity. Added financing took the form of a $18.9 million Housing Production Trust Fund loan from the D.C. DHCD. Neighborhood Development Co. is the community’s developer. Total development cost is $45.2 million. The development will feature 32 one-bedroom, nine two-bedroom and eight three-bedroom apartments. Amenities will include a community room.

For the construction of Belmont Crossing, DCHFA issued $48.8 million in tax-exempt bonds, while underwriting $41.5 million in federal LIHTC equity. DHCD contributed an additional $37.6 million HPTF loan. Total development costs will come to $104.5 million.

Gilbane Development Co., MED Developers, Equity Plus Manager LLC and Housing Help Plus will serve as developers of the community. Unit mix will feature eight four-bedroom, 44 three-bedroom, 49 two-bedroom and 68 one-bedroom apartments. Among the highlights of the amenity suite will be a business center. Last month, DCHFA funded a $105 million affordable development called Park Morton, Phase I.

Washington, D.C. – The District of Columbia Housing Finance Agency (DCHFA) has financed the construction of 3450 Eads Street and Belmont Crossing Phase I in Wards 7 and 8, respectively. 3450 Eads Street will bring 49 units to the River Terrace neighborhood and Belmont Crossing will consist of 169 units in the Washington Highlands neighborhood.

As prosperity and population in DC grow, residents with low incomes increasingly struggle with the District’s high and rising housing costs. The disappearance of affordable housing is a result of many generations of policy choices. This lack of affordable housing, particularly for larger families, puts enormous stress on family budgets and leaves many at risk of eviction and homelessness.

Black and brown residents are disproportionately harmed by the disappearance of affordable housing. Nationwide, nearly half of all Black renters are housing insecure whereas about a quarter of white renting households are housing insecure. A dramatic increase in the cost of housing in DC has led to a decades-long wave of displacement. An analysis of census data shows that in 2000, 32 of DC’s 62 residential neighborhoods were majority Black but by 2020, only 22 residential areas remained majority Black. In that time period, the Black population declined by nearly 58,000 while the white population grew by almost 86,000.

Having a safe, stable, and affordable place to call home is intrinsically connected to positive life outcomes in school performance, job retention, physical and mental health, and economic security. It ensures families aren’t forced to make difficult decisions between paying the rent or putting food on the table. When individuals and families don’t have to spend most of their income on housing, they may be able to save for and invest in their futures.

The District has many tools to create and preserve affordable housing and end displacement of residents with limited or low incomes, who because of longstanding racial inequities are likelier to be Black and brown. This guide gives a brief overview of the District’s programs designed to either create or preserve affordable housing, or to help make existing housing more affordable to residents through rent subsidies.

**Affordable for Whom? **

The idea of what’s affordable is relative. Usually, housing is considered affordable when a household spends no more than 30 percent of its income on housing and utilities. In DC, Black residents are nearly twice as likely as white residents to spend more than 30 percent or more of a household’s income on rent. This “rule of thumb” dates back to 1969 and is widely used in housing policy. While useful, the measure has its flaws—namely that it does not take into account ability to pay. A household that spends 30 percent of a $300,000 income on housing will have a lot more left to spend on other necessities than a household with a $25,000 income.

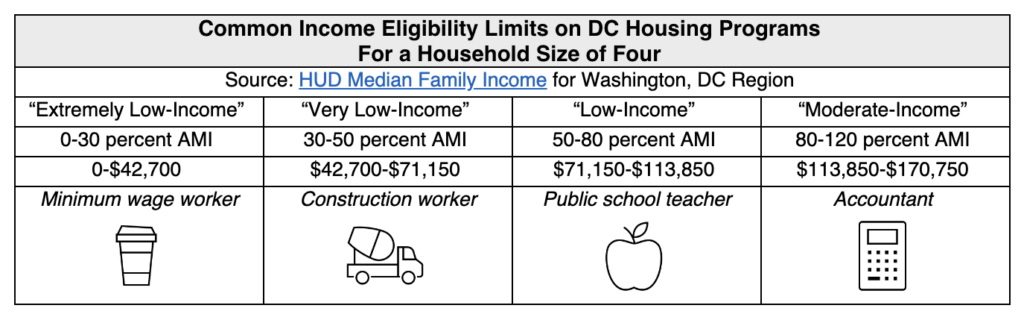

Eligibility for certain housing assistance programs is based on an individual’s or family’s income and how it compares with average income levels and costs (_Table 1). _In federal and DC affordable housing programs, a person’s eligibility is based on how their income compares with the area median income (AMI). That is the income for the middle household in the DC region, which includes not only DC but the suburbs. Currently, the Washington region’s AMI is $142,300 for a family of four, which skews higher due in part due to the inclusion of suburban regions that have higher income levels.

Some housing programs, like public housing, serve primarily “extremely low-income” households, or those below 30 percent of AMI, or $42,700 for a family of four in DC. This includes many residents on fixed incomes such as seniors living on Social Security payments. Other programs, such as project-based vouchers (see below) help “very-low income” families (under $71,150 in DC for a family of four) and “low-income” families (under $113,850). The wide range of incomes that can qualify as “low” –particularly when there is a lack of targeting or poor accountability for reaching targets—sometimes allows developers receiving subsidies to meet their affordable housing commitments with high rents and results in less housing being made affordable for those with extremely low incomes.

While families at many incomes struggle with the cost of housing in DC, where the average rent for a one bedroom is $2,428 as of October 2022, extremely low-income renters struggle the most. Most DC families with incomes below 30 percent of AMI spend more than half their income on rent, meaning many are at risk of eviction and have little left over for other basics such as health care, transportation, and educational expenses. More than 25 percent of households with incomes under 50 percent of AMI also spend more than half their income on rent.

**What Tools Do We Have for Affordable Housing? **

The current shortage of affordable housing is a result of deliberate policy and spending choices, past and present, at both the federal and local level. However, federal and local governments can and do step in to help subsidize costs. They can do that in a variety of ways, including subsidizing the construction of housing to ensure that new developments include affordable units, or by providing renters or homeowners direct cash assistance so that those residents can stay in their homes.

Production and Preservation

The District uses grants and low-cost loans to incentivize developers to create and preserve affordable housing.

-

Housing Production Trust Fund (HPTF) – DC’s largest affordable housing tool provides low-cost loans and grants to developers to help build and preserve affordable homes. Though the target has never been met, DC law requires that 50 percent of HPTF funds be used to produce housing affordable to those with incomes below 30 percent of AMI.

-

Preservation Fund – A revolving loan fund that allows the District to leverage private dollars in a three-to-one match to offer acquisition and predevelopment financing to developers for projects that preserve existing affordable housing

-

First Right to Purchase Assistance Program (FRPP) – When active, this DC program helped tenants with lower incomes exercise their right to purchase their apartment buildings under the Tenant Opportunity to Purchase Act (TOPA). The program has not accepted applications for several years.

Local Rent Supplement Program (LRSP)

Through this program, the DC government uses local dollars, as opposed to federal funding, to help cover the difference between the rent a family can afford to pay and the full rent. The program operates through three different voucher types.

-

Tenant-based – Tenant-based vouchers are provided directly to families or individuals for use with any rental unit with priced within 185% of the Fair Market Rent in the District. The voucher stays with the family or individual, even if they decide to move to another rental unit in the District.

-

Project-based – The District awards project-based vouchers to for-profit or nonprofit developers for specific units that these developers make affordable to residents earning “low incomes,” which includes incomes up to 30 percent, 50 percent, or 80 percent AMI. Developers receiving financing from the HPTF (described above) rely on these vouchers to cover ongoing operating and maintenance costs and keep rents low for tenants with low incomes. Unlike tenant-based vouchers, these vouchers are not portable and stay with the unit. The units must be made affordable over the life of the building. Although it is not required, many project-based vouchers are awarded to developments that also provide supportive services, such as counseling, to residents.

-

Sponsor-based – Sponsor-based vouchers are awarded to a landlord or non-profit group for affordable units they make available to families with low incomes. Unlike project-based vouchers, these vouchers are portable and can be moved to another unit run by the non-profit or the landlord. Sponsor-based vouchers are awarded only to groups that agree to provide supportive services to residents housed in the affordable units.

Federal Programs with Local Administration

The federal government provides funding for public housing and a range of affordable housing programs aimed at increasing the supply of affordable housing and making existing housing more accessible.

-

Low Income Housing Tax Credit (LIHTC) – This is the largest federal program for subsidizing the construction of apartments with rents below market rates. The federal government gives states and local agencies authority to issue tax credits for acquisition, rehabilitation, or new construction of housing that is affordable to households with low and moderate incomes.

-

Public housing – Funded by the federal government and operated and subsidized by the DC Housing Authority (DCHA), public housing provides deeply affordable housing to District tenants. The rent charged to each tenant depends on their income and changes as their income changes. Due to DC’s high levels of economic struggle, public housing is in high demand. In 2022, 40,000 people were on DCHA’s waiting list for affordable housing.

-

Housing Choice Voucher Program (HCV) – This federal program, administered by DCHA, operates much like DC’s tenant-based (LRSP) vouchers but is funded with federal, rather than local, money.

Legal Requirements and Restrictions

Elected officials have passed laws to incentivize or mandate the creation or preservation of affordable housing and to stabilize housing for existing renters.

-

Public land disposition – When DC sells public land for housing development of a building of ten or more units, up to one-third of the new units must be affordable for the life of the building.

-

Inclusionary Zoning (IZ) – This program requires private-market developments to set aside a share of their buildings as affordable, at 80 percent AMI for homeownership and 60 percent AMI for rentals. The District runs a lottery to allocate IZ units to people seeking housing.

-

Tenant Opportunity to Purchase Act (TOPA) – By law, when a building owner decides to sell, tenant associations have the right either to, 1) purchase their building to convert it to a co-op or condominiums or 2) assign their rights to a developer to purchase the building. Tenants must form an association and file an intent to purchase in order to take advantage of TOPA.

-

District Opportunity to Purchase Act (DOPA) – If the tenants’ attempt to purchase their apartment building under TOPA fails, the District can intervene and preserve some affordable homes, though the District has never taken advantage of this option.

-

Rent Control – The local Rental Housing Act of 1985 limits increases in rent charged for units in certain buildings. Rent control only applies to buildings (mainly multi-unit properties) built before 1975, meaning that no new rent-controlled buildings have been added to DC’s housing supply in almost 40 years.

Paths to Homeownership

Generations of exclusionary, racist practices have led to a large racial wealth gap and homeownership gap: in DC, only 34 percent of Black residents own their homes compared with nearly 49 percent of white residents. In response to this racial wealth gap, In 2022, Mayor Bowser created the Black Homeownership Strike Force, which released a list of recommendations to increase Black homeownership. Right now, the District provides low- or no-interest loans to eligible residents through a range of programs in order to expand access to homeownership.

-

Home Purchase Assistance Program (HPAP) – This program offers interest-free loans and closing cost assistance to people looking to buy a home in the District. The level of financing is dependent on household income and size, need, and the availability of funds. In FY 2023, the District increased the maximum loan amount from $80,000 to $202,000 per homebuyer, in response to increased property costs.

-

Employer-Assisted Housing Program (EAHP) – This program is similar to HPAP but is available only to District government employees. There is no income cap for EAHP applicants, but it is available only to first time homebuyers.

-

DC Open Doors (DCOD) – Administered by the DC Housing Finance Agency, this program offers assistance to eligible buyers for home purchase loans, down payments, and closing costs.

How Can DC Strengthen Existing Affordable Housing Tools?

A growing gap between rents and housing prices and wages for those with lower paid jobs has made it increasingly difficult for residents with low and moderate incomes to remain in the District. Given the enormity of its affordable housing crisis, lawmakers should adopt a thoughtful, holistic anti-displacement strategy that pairs long-term solutions with programs that meet residents’ urgent needs. Lawmakers must also ensure strong oversight to support the success of this strategy.

Plan for Long-term Affordability

DC will only make progress towards addressing its housing affordability crisis if lawmakers commit to making that affordability permanent. Lawmakers can achieve this in a number of ways, including expanding and strengthening rent control and ensuring that HPTF investments are both paired with ongoing operating subsidies to keep tenant rents low.

Invest in Resources for Residents with Urgent Housing Needs

While recent major investments in production tools such as the HPTF help the District increase the amount of affordable housing, progress toward production goals is slow and residents need access to housing now. The District must also provide stable and affordable housing to residents in the immediate term.

To do that, lawmakers can invest money in the Emergency Rental Assistance Program (ERAP). ERAP prevents evictions by helping residents pay overdue rent and legal costs. District leaders can also increase funding for, and improve implementation of, its voucher programs to ensure that residents are able to quickly find housing that meets their needs. Policymakers can also work closely with District agencies and community-based organizations to strengthen tenant protections and prevent evictions and other forms of displacement.

Commit to Transparency, Oversight, and Improved Management

As DC invests more in affordable housing programs, lawmakers must hold DC agencies accountable to implementing these programs effectively via increased oversight. Oversight is only possible with transparency, or publicly accessible information. With regular, standardized, and clear reporting about program implementation from agencies, DC Council can make appropriate legislative or funding changes in order to meet goals such as the production of affordable housing, the provision of vouchers, or the upkeep of public housing.

Washington, D.C. – The District of Columbia Housing Finance Agency (DCHFA) issued $51.2 million in tax exempt bonds and underwrote $31.5 million in federal Low Income Housing Tax Credit (LIHTC) equity for the construction of Park Morton Phase I on November 17, 2022. A part of the Deputy Mayor for Planning and Economic Development New Communities Initiative, this project will help revitalize this transit-oriented, amenity rich neighborhood and provide 40 public housing replacement units

NORTH BETHESDA, MD - Foulger-Pratt and its partners broke ground today on Paxton, a 148-unit, 160,000 square-foot market-rate quality all-affordable apartment community located at the intersection of Benning Road NE & 16th Street NE in Washington, D.C.

The development is a collaboration between real estate developer Foulger-Pratt and Enduring Affordable Housing Corporation.

The $101 million project includes financing by the District of Columbia Housing Finance Agency (DCHFA).

Additional partners include Capital One as the construction lender and the federal LIHTC investor, Hudson Housing Capital as the LIHTC syndicator, Monarch Private Capital as the D.C. LIHTC investor, D.C.’s Department of Human Services (DHS) as the Permanent Supportive Housing operating subsidy provider, Freddie Mac Multifamily as the permanent lender, the D.C. Housing Authority as the project-based voucher provider and the District of Columbia Housing Finance Agency (DCHFA) as the tax exempt bond lender.

DCHFA issued $46.92 million in tax exempt bonds and underwrote $42.02 million in D.C. and federal Low Income Housing Tax Credit (LIHTC) equity in addition to a $29.02 million Housing Production Trust Fund loan from the D.C. Department of Housing and Community Development.

Paxton will contain eight studio, 87 one-bedroom, 16 two-bedroom and 37 three-bedroom rental apartments.

“Paxton will bring 148 market-rate quality units to NE D.C.,” said Brigg Bunker, managing partner and chief operating officer for Foulger-Pratt. “As part of our continued commitment to providing solutions to the area’s affordable housing crisis, Foulger-Pratt has officially launched an affordable housing initiative. We feel we are in a position to leverage our years of expertise in developing quality market-rate product to help address the nationwide housing crisis. We are proud to be part of a solution that makes housing accessible and to better the communities where we do business.”

At Paxton, 15 apartments will be reserved for residents with incomes at or below 30% of area median income (AMI) and are set aside as permanent supportive housing (PSH) units. Families residing in Paxton’s PSH units will receive support services through Community of Hope, a local organization working to end family homelessness and improve health while making D.C. more equitable.

The remaining 133 units will be rented to residents with incomes at or below 50% AMI.

All residents will have access to services through Hope Multiplied, a D.C.-based nonprofit providing community development, health and wellness, and socio-economic programs.

Paxton will contain 5,300 square feet of amenity space including access to a business center, landscaped courtyard, fitness center and clubhouse. Additionally, Paxton will provide garage parking, bike storage, on-site storage, concierge services, and security to future residents.

Paxton’s transit-oriented location provides immediate access to the DC Streetcar and proximity to the H Street Corridor’s retail, restaurants, performing arts venues, and medical facilities.

Capital One provided $94 million in debt, equity and forward agency financing for Paxton, including a $39.2 million construction loan, a 36-month forward commitment for a $21.1 million Freddie Mac fixed-rate loan, and a $34.2 million investment in Low Income Housing Tax Credits (LIHTC) to preserve the long-term affordability of the property.

“Addressing the nationwide gap in affordable housing requires innovative funding to support new construction and housing preservation,” said Ed Delany, senior director and senior capital officer of Community Finance for the Mid Atlantic at Capital One. “This groundbreaking embodies how that funding can bring new housing to a market in need, as Capital One provided comprehensive financing to Foulger-Pratt for Paxton that spanned construction, equity and permanent financing.”

Hickok Cole is the architect for the project. TM Associates will serve as the property manager. Paxton is set to be delivered by April 2024.

**ABOUT FOULGER-PRATT: **Established in 1963, Foulger-Pratt is a real estate investment and development firm distinguished by its long-term focus and extensive experience executing successful mixed-use, transit-oriented projects. The firm’s disciplined culture and vertically integrated platform have enabled it to develop more than 15 million square feet of commercial office, multi-family residential and retail projects. by its long-term focus and extensive experience executing successful mixed-use, transit-oriented projects.

Foulger-Pratt is privately owned, led, and staffed by many of the industry’s most talented professionals. The firm’s culture has been carefully cultivated for the last half-century through deliberate effort to operate consistently in accordance with specific core values. The result is a reputation of unmatched integrity, accountability, and vision. For more information, visit www.foulgerpratt.com

The NHP Foundation (NHPF), a leading affordable housing provider, welcomed residents this past month to the newly renovated and preserved Anacostia Gardens Apartments. Redevelopment and preservation funding for the development was made possible by District of Columbia Department of Housing and Community Development (DHCD), which provided a $9,850,000 HPTF gap financing loan, and the DC Housing Finance Agency (DCHFA) who issued tax-exempt bond financing and made accessing 4% Low Income Housing Tax Credits possible.

The project also received the equity from the National Affordable Housing Trust (NAHT) which it in turn raised from its investor, UnitedHealthcare whose $8.08 million low-income housing tax credit investment supports this affordable housing project as part of the company’s commitment to advance health equity in underserved communities. In addition, R4 Capital supplied the senior tax-exempt bond debt.

“DCHFA’s investment reinforces our leadership’s commitment and continued focus on improving health outcomes through investments in quality, beautiful, service-enriched affordable housing,” said Christopher E. Donald, Executive Director/CEO, DCHFA.

NHPF acquired the 100-unit Ft. Dupont development in 2016 in partnership with the Anacostia Gardens Tenant Association, Inc. (AGTA) which exercised its rights under the District’s Tenant Opportunity to Purchase Act (TOPA) and selected NHPF as the developer on the rehabilitation of the building which includes 37 one-bedroom, 49 two-bedroom and 14 three-bedroom units.

“UnitedHealthcare is committed to addressing social determinants of health at the local level,” said Kathlyn Wee, CEO, UnitedHealthcare Community Plan of the District of Columbia. “Our work to support new affordable housing opportunities will drive better health outcomes in the communities we serve.”

The Anacostia Gardens rehabilitation included energy improvements, interior unit replacements and upgrades, dramatically improved common areas, and added measures to make the building handicap accessible. Additional work included repairs to exterior sidewalks, all new windows, light fixtures, security systems, roofing, the addition of solar panels and more.

The renovation also featured kitchen and bathroom upgrades, new smoke and carbon monoxide detectors, and HVAC systems and thermostats. In addition to the apartments, there is a playground, on-site parking, a community room, and central laundry facility. The fully renovated community room includes additional recreation and meeting spaces.

“The reopening of Anacostia Gardens marks a milestone in our TOPA work in the district, and the development will also be certified as a ‘Green Communities’ project,” said NHPF President and CEO Richard Burns. “This achievement showcases the best of what can be done in a successful partnership.”

Representing D.C. Mayor Muriel Bowser, Department of Housing and Community Development Interim Director Drew Hubbard added, “By investing to preserve affordable units like Anacostia Gardens, we believe that it gives long-time residents an opportunity to benefit from the progress being made in their community and not have to relocate or feel unsettled.”

The Ribbon Cutting event included free onsite health screenings courtesy of Mary’s Center, a federally qualified health center and local provider of health services.

About The NHP Foundation

Headquartered in New York City with offices in Washington, DC, and Chicago, IL, The NHP Foundation (NHPF) was launched on January 30, 1989, as a publicly supported 501©(3) not-for-profit real estate corporation. NHPF is dedicated to preserving and creating sustainable, service-enriched multifamily housing, and single-family homes that are both affordable to low- and moderate-income families and seniors, and beneficial to their communities. NHPF’s Construction Management Group provides in-house resources dedicated to infrastructure review, infrastructure development and costs management. Through Family-Centered Coaching, NHPF’s subsidiary Operation Pathways engages with, and assists, families experiencing poverty and other hardship, to problem-solve together. Through partnerships with major financial institutions, the public sector, faith-based initiatives, and other not-for-profit organizations, NHPF has 61 properties, including over 10,000 units, in 16 states and the District of Columbia. For more information, please visit

https://www.nhpfoundation.org.

Washington, D.C. – The District of Columbia Housing Finance Agency (DCHFA) has financed the rehabilitation of Ridgecrest Village Phase I in Ward 8’s Shipley Terrace neighborhood. The Agency issued $21.9 million in tax exempt bonds and underwrote $16.83 million in D.C. and federal Low Income Housing Tax Credit (LIHTC) equity. Phase I of the project will consist of remodeling 13 existing buildings on the property originally constructed in 1951.

Washington, D.C. – The District of Columbia Housing Finance Agency (DCHFA) financed the construction of The Paxton, 148 affordable apartments in Ward 7. The Agency issued $46.92 million in tax exempt bonds and underwrote $42.02 million in D.C. and federal Low Income Housing Tax Credit (LIHTC) equity for this new construction project. All units at this property will be reserved for residents earning 50 percent or less of the area median income (AMI).